Electrical Insurance Explained: What's Covered in Your Home Policy?

When protecting your home and belongings, having the right insurance coverage is crucial. One aspect that often gets overlooked is electrical insurance. Many homeowners need unawarded aware of what is covered in their home insurance regardingcomes to electrical faults.

In this blog post, we will delve into the specifics of electrical insurance and what you need to know to ensure you have the proper coverage.

Understanding the Basics of Home Insurance Policies

Diving into the world of home insurance can feel like navigating a maze, but it's a journey worth taking to safeguard your cherished home and belongings. At its core, a home insurance policy is your financial safety net, designed to catch you when unexpected disasters strike.

These policies typically encompass a range of coverages, from structural damage to your home, loss or damage to personal property, and even liability protection should someone be injured on your property. What's particularly relevant to our discussion is understanding how these policies approach the topic of electrical faults. It's a nuanced area, with the specifics often buried in the fine print of your policy documents.

Each policy spells out what kinds of incidents are considered covered perils—events like fires, theft, and certain natural disasters are usually on the list. But when it comes to the intricacies of electrical issues, the waters can get a bit murkier. That's why gaining a solid foundation in the basics of home insurance is a crucial first step in unraveling the mysteries of electrical insurance coverage.

By familiarizing yourself with the fundamental protections provided, you can better navigate the specifics of what's covered—and what's not—regarding electrical faults.

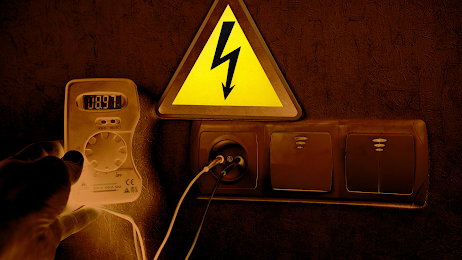

Common Causes of Electrical Faults in Homes

Electrical faults in our homes can sneak up on us, often resulting from conditions we might overlook or underestimate. Imagine your home as a living system, with its veins being the electrical wiring that powers everything from your morning coffee ritual to your nightly wind-down with a favorite show. This system, like any other, can face challenges.

Age is a significant factor; older homes with wiring that hasn't been updated in decades are more susceptible to faults. Similarly, our quest for convenience—plugging in more gadgets and appliances than an outlet was designed to handle—can lead to overloading and, subsequently, faults. Nature also plays its role through lightning strikes or power surges, which can wreak havoc on our home's electrical system.

In navigating these potential pitfalls, knowledge is power. Being aware of these common causes encourages proactive steps towards safeguarding our homes. Regular check-ups by qualified electricians can spot these issues early, preventing them from evolving into more significant, more dangerous problems. It's about creating a safe haven, ensuring our homes remain the cozy sanctuaries we cherish.

Does Standard Home Insurance Cover Electrical Faults?

Navigating the specifics of whether standard home insurance policies offer coverage for electrical faults can feel like piecing together a puzzle. In essence, these policies do often provide a safety net for damages resulting from electrical faults, but with an important caveat: the incident must fall under what's defined as a covered peril.

This means that if an electrical fault leads to a situation such as a fire, and fires are listed among the covered perils in your policy, then you’re likely to receive support from your insurance for the damages incurred. However, the devil is in the details, as they say. It's critical to closely review your policy's declarations and exclusions. There might be limitations on the coverage depending on the cause and nature of the fault.

For example, if an electrical fault arises from neglected maintenance or is deemed a result of normal wear and tear, it might not be covered. This highlights the importance of having a clear and thorough understanding of your policy, ensuring you’re adequately protected before the unexpected happens.

Specific Scenarios Where Electrical Faults Are Covered

Understanding when your home insurance policy steps in to cover electrical faults is akin to learning the rules of a complex game; it requires attention to detail. In scenarios where electrical faults ignite a fire or cause significant damage to your home's structure, most policies will offer coverage as these incidents typically fall under the umbrella of covered perils.

Importantly, coverage extends to instances where external forces, like a lightning strike leading to power surges that damage your electrical systems, play a pivotal role. These specific circumstances underscore the insurance's role in providing a financial safety net against sudden and unforeseeable mishaps.

However, it’s essential to differentiate between these instances and situations rooted in ongoing maintenance issues, as the latter often falls outside the scope of coverage. Engaging with your policy details allows you to discern the nuances of coverage, empowering you with the knowledge to navigate the electrical insurance landscape effectively.

By pinpointing these scenarios, you can better understand the protections afforded to you, ensuring peace of mind in your home’s defense against electrical anomalies.

Understanding Policy Exclusions and Limitations

Peeling back the layers of your home insurance policy reveals a complex landscape of coverages, exclusions, and limitations, each with its own set of rules. Navigating this terrain is essential to truly understand the scope of your electrical insurance coverage.

Exclusions are specific conditions or scenarios where coverage does not apply. These can range from damage due to neglected maintenance, deemed a part of normal wear and tear, to issues arising from DIY electrical work gone wrong. Limitations, on the other hand, might cap the amount you can claim for certain types of damage or restrict coverage to specific situations. It's akin to knowing the boundaries within which you're operating what's in and what's out.

By getting to grips with these parameters, you can identify potential gaps in your coverage. This understanding empowers you to have more informed discussions with your insurance provider, ensuring that you're not just covered, but comprehensively protected. This proactive approach means you're not left in the dark when it matters most, ensuring a brighter, more secure future for your home.

Optional Coverages for Enhanced Protection

Exploring additional layers of protection for your home against electrical faults can be a smart move. While standard policies offer a broad range of coverages, tailoring your home insurance with optional add-ons can provide that extra peace of mind.

Consider the benefits of equipment breakdown coverage, which can be a lifesaver for those unexpected moments when essential home systems fail due to an electrical issue. Power surge protection is another vital addition, guarding against the sudden spikes in electricity that can damage electronics and appliances common culprits of home disruptions.

Furthermore, for homes with extensive outdoor electrical systems, adding coverage for underground wiring can protect against the high costs of repairs or replacements due to damage.

Engaging in a dialogue with your insurance provider about these options allows you to customize a policy that not only fits your unique needs but also fortifies your home’s electrical resilience. Remember, the goal is to navigate through life’s surprises with as much ease and assurance as possible, and these optional coverages are tools for achieving that security.

Steps to Prevent Electrical Issues in Your Home

Creating a home that's safe from electrical mishaps begins with proactive measures. Engage in regular check-ups of your home’s electrical system by hiring qualified electricians. These professionals can spot minor issues before they evolve into more severe problems, effectively reducing the risk of electrical faults.

Another simple yet effective step is to mind how many devices you're plugging into a single outlet. Overloading outlets is a common cause of electrical issues but can be easily avoided by using power strips with built-in surge protectors and being mindful of the electrical demand you're placing on any one circuit.

Additionally, consider the age and condition of your appliances and electronics. Older or faulty devices can pose a higher risk for electrical issues, so keeping them in check, upgrading when necessary, and using surge protectors can further safeguard your home.

Implementing these strategies not only contributes to a safer living environment but also empowers you as a homeowner to minimize potential electrical hazards.

Filing a Claim for Electrical Damage

Navigating the aftermath of electrical damage in your home can be daunting, but taking the right steps when filing a claim can make the process more manageable. Start by thoroughly documenting the damage with photos and videos; these will be invaluable in supporting your claim.

Next, locate any receipts or warranty information for affected appliances or systems, as these can provide proof of value and condition before the damage. With your evidence in hand, reach out to your insurance provider as soon as possible to report the incident.

They'll walk you through the next steps, which often include filling out claim forms and possibly arranging for an inspection of the damage. Clear communication and detailed documentation are your best tools during this process, ensuring that you can navigate the claims process with confidence and receive the support you need to restore your home.

Comments

Post a Comment